Trade Tariff Duty Rate Tool

Optimize import costs through strategic tariff analysis

Our Trade Tariff Duty Rate Tool is a specialized solution for supply chain and procurement professionals seeking to optimize import costs. The system allows you to search, compare, and analyze commodity import rates across different jurisdictions, identify classification opportunities, and make data-driven decisions for significant cost savings.

Why Choose Our Trade Tariff Duty Rate Tool

Strategic advantages for global importers

Cost Reduction

Identify duty-saving opportunities across your product portfolio. Our clients typically discover 5-15% in potential duty savings by optimizing commodity classifications and sourcing strategies.

Compliance Assurance

Ensure proper tariff classification with access to comprehensive, up-to-date tariff information. Reduce the risk of customs audits, penalties, and retroactive assessments.

Strategic Planning

Make data-driven decisions for product sourcing, manufacturing location, and supply chain design. Our tool provides the insights needed for long-term cost optimization.

Key Features

Advanced capabilities for trade tariff optimization

Comprehensive Tariff Database

Access to complete, up-to-date tariff schedules from major trading jurisdictions including the EU, UK, US, China, and more.

Intelligent Classification Suggestions

AI-powered classification suggestions that help identify potential alternative tariff classifications for your products.

Multi-jurisdictional Comparison

Compare duty rates across different countries and trading blocs to optimize sourcing and manufacturing decisions.

Free Trade Agreement Analysis

Identify and leverage preferential duty rates available under various Free Trade Agreements and preference programs.

Bulk Import Analysis

Upload and analyze entire product catalogs to identify classification opportunities and potential savings across your portfolio.

Duty Impact Forecasting

Model the financial impact of tariff changes, new sourcing locations, or product modifications on your import duties.

See It In Action

Watch how our Trade Tariff Duty Rate Tool can transform your import cost management

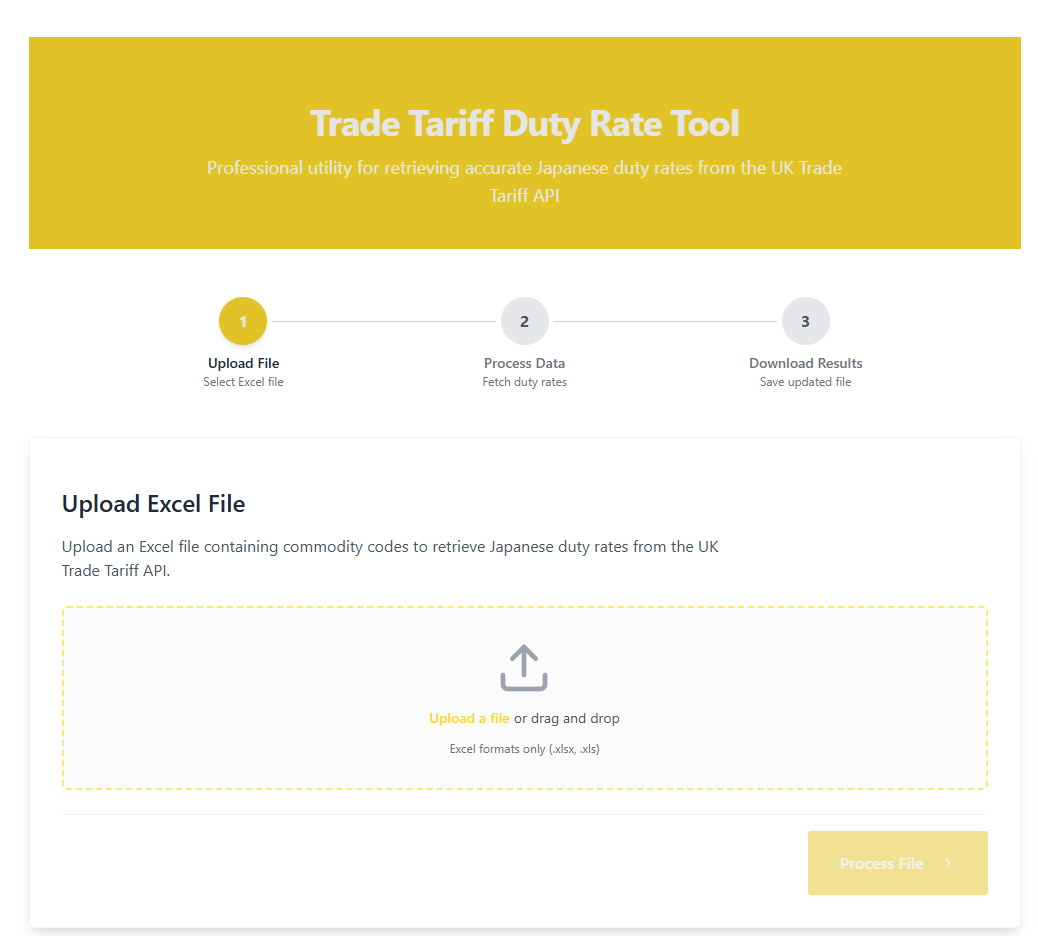

How It Works

Four steps to optimize your import costs

Product Analysis

Upload or enter your product details including current classifications and specifications.

Classification Review

Our system analyzes your products and suggests potential alternative classifications.

Rate Comparison

Compare duty rates across classifications and jurisdictions to identify savings opportunities.

Strategy Implementation

Apply insights to update classifications, adjust sourcing, or modify products for optimal duty savings.

Business Use Cases

How companies leverage our Trade Tariff Duty Rate Tool

Electronics Component Sourcing Optimization

Global Electronics Manufacturer

A multinational electronics manufacturer was facing increased tariffs on components sourced from traditional suppliers. Using our Trade Tariff Duty Rate Tool, they analyzed alternative classification possibilities and sourcing locations for their component portfolio.

Results:

- Identified correctly classified but overlooked components with lower duty rates

- Discovered alternative country sourcing opportunities with preferential rates

- Implemented minor product modifications to qualify for more favorable tariff classifications

- Achieved annual savings of $3.4 million in import duties

Fashion Supply Chain Restructuring

European Fashion Retailer

A fashion retail chain with operations across Europe needed to reassess their supply chain following Brexit and changes to EU-UK trade arrangements. Our tool helped them analyze the duty impact of different manufacturing and distribution scenarios.

Results:

- Created a duty impact model for multiple supply chain configurations

- Identified optimal manufacturing locations to leverage preferential trade agreements

- Developed a phased approach to supply chain restructuring based on duty impact

- Reduced anticipated post-Brexit duty costs by 62%

Optimize Your Import Costs

Contact our team today to discuss how our Trade Tariff Duty Rate Tool can help your company identify significant duty savings opportunities.